IRS Form 3903

Why You Should Pay Attention to Form 3903

- Figuring IRS Qualifications for Moving Deductions Post-Move

- Moving Expenses Only Count If It's For A New Job

- The "Use Tests" Requirements

- The Distance Test

- The Time Test

- Buying A House: Itemize Moving Expenses Away

- Married Filing Jointly & Selling Your Home

- Update Your Change of Address to the IRS

- These are Guidelines, Follow Most Recent IRS Form 3903

1. Figuring IRS Qualifications for Moving Deductions Post-Move

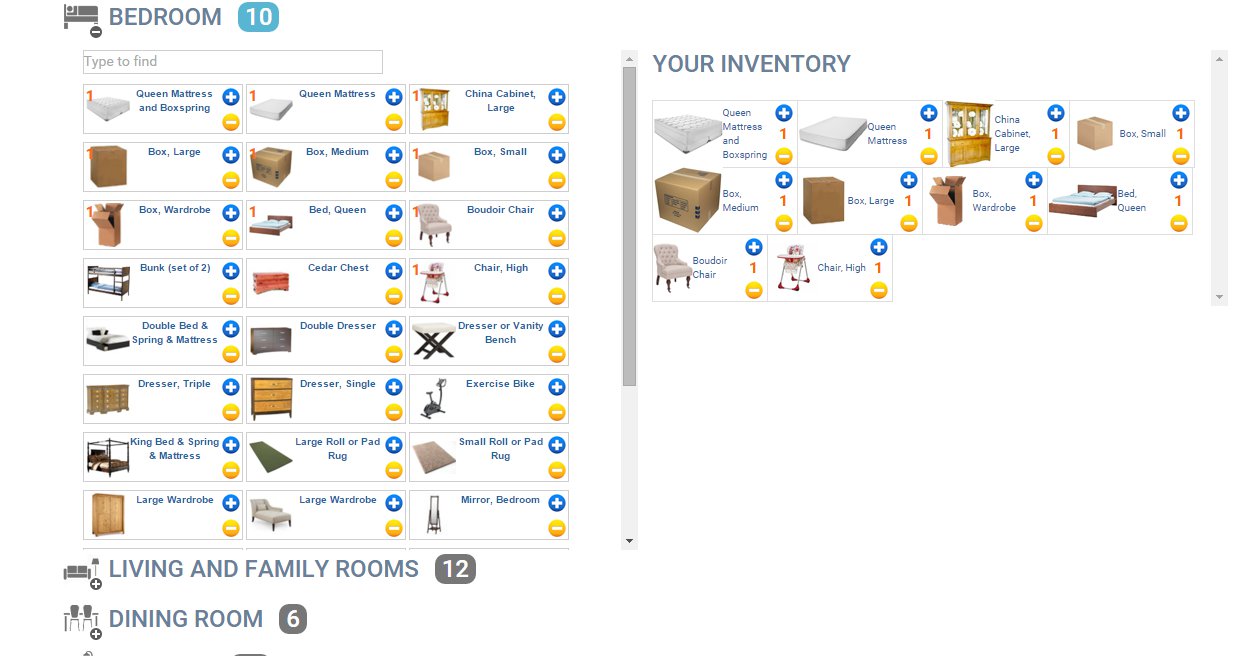

When it comes to dealing with the IRS, filing your taxes and figuring out what you can write off may seem like the ultimate chore. On the other hand, if you know what kinds of expenses that are legitimate to deduct the process can be much easier. Moving is an expensive process whether your staying local in your state or moving interstate. Just hiring a moving company, driving, packing, eating, paying for gas or flights, etc. can be overwhelming for your bank account.The IRS seems to understand this too, so they are pretty lenient with their basic IRS Form 3903. They also seem to know how tedious and precise you have to be in order to receive any deductions for your typical moving expenses (unless otherwise defined). There are so many employee, corporate, and office relocations happening every day that should be informed about possible deductions.

2. Moving Expenses Only Count If It's For A New job

If you have to or choose to move because of your job, more specifically your workplace, you may be able to save in the long run. These moves are considered moving expenses by the IRS, but there are strict requirements. If you got a new job, are self-employed and relocate, or an employee that went through a relocation you may be eligible. First, you must meet the IRS Use Tests which are simply 2 tests of time and distance. These are really only to see if you've really moved because of your job's location.3. The "Use Tests" Requirements

While it's true that you that you can actually save money on your recent relocation, it is not to an extent of the IRS paying for a moving company for example. It's still worth trying to make back some of that extra money on that budgeted move. It's especially worth it if you had some unexpected financial surprises during the moving process.

However, it requires you to pass two test before you qualify for deductions on your moving expenses. These 2 tests are meant to test whether or not you really deserve to be reimbursed (if not by an employer or self) for moving due to a new workplace.

Essentially what they are trying to see is if you stick around in the area for a year and maintain a job, typically these tests show the IRS that you allowed moving expenses.

4. The Distance Test

- For instance, if you moved to pursue a new workplace, it must be at least 50 miles farther from your old home than your old job was. This means that if you worked 5 miles from home before, now your new workplace must be 55 miles from your new home.

- If no prior job, then they default to 50 miles automatically.

- The concept is that the distance between your new home and workplace are at least 50 miles farther than your last home and workplace. The two points always have to be shortest of most commuting.

5. The Time Test

- If you moved due to an office relocation, as an employee, you’re still required to work full time in your work’s prevailing or surrounding location for AT LEAST 39 weeks during the 12 months following your move.

- If you’re self-employed, you must work full time in your new workplaces general area for at least 39 of those weeks and they MUST be during the FIRST 78 weeks of the 24 months.

- This basically means they want you to stay in the local area you moved to as a way to prove it your moving expenses were really used for work-related reasoning.

6. Buying a House: Itemize Moving Expenses Away

Most people find that if you have recently bought a house and are celebrating newfound ownership, you can also celebrate the ease of itemizing any deductions. If you’ve always been a homeowner, then this part is easy. Even if you’ve accrued real estate taxes through mortgages, these real estate taxes can both be deducted from your taxes if you itemize.

This is a huge selling point to most couples or partners looking to buy. Other general expenses can be itemized even though they vary in type and range. Everything from charity donations to medical costs. It’s as easy as a little organizational effort.

7. Married Filing Jointly & Selling Your Home

Selling your home may or may not be a qualifying option for either you or your spouse. Regardless, if you and/or your spouse pass the Use Tests (Time/Distance), either of you may be entitled to exclusion of up to $250,000 ($500,000 if married filed jointly) on your federal taxes.- Typically the exclusion rule applies if you sell and move out of your MAIN home every two or so years. There are requirements you must meet in order for any reductions.

- You must be the homeowner of the main home for a minimum of 2 of the 5 years prior to owner or spouse (if applied). Secondly, you must not have benefitted financially (or gained) by excluding up to $250,000 of federal taxes on any prior house you owned during the two years before your most recent one, or the one you’re in the process of.

- By filing taxes jointly as a married couple the same year of selling, you will meet the IRS requirements for moving expense deductions. Remember, BOTH you and your spouse would need to meet both requirements in order to qualify for the $500,000 tax deduction maximum.

- If you and your spouse are not able to meet the ownership and use tests, you might still meet the necessary guidelines due to your work, health problems, or the 'unforeseen'.

- Unforeseen is a very vague and general word to describe events that can range from charitable to natural disasters. Something to look up if you filed married jointly with the IRS.

8. Update Your Change of Address to the IRS

When you made your most recent move make sure not to forget about updating the U.S. Postal Office. This way your address will forward to the IRS and notify them to send any tax refunds or communicate with you directly. When determining if you can write off some of your recent moving expenses, this can be the most important part of the process.

Don't shy away from open communication or correspondance with the IRS because they may need additional information or vice versa. It also will let your employers know about any address changes so that you can receive all of your W-2s at the end of the year. Remember, Without that information, you can’t save on moving expenses or any other expense for that matter.

9. These Are Guidelines, Follow Most Recent Form 3903

This was based on the 2017 IRS version of the Form 3903, however, if you find yourself with more questions refer to the most recent form or the form you most recently filed with. It will then refer you to another page in the booklet. This is publication 543 in the IRS booklet. This is yet another reason why it is critical to update your new address. It is important for you to understand how the IRS works and to be able to communicate with the IRS.

Add Comment